Planetary Correlations

Uranus-Pluto: Associated with periods of rapid innovation and democratizing access to technology as well as funding.

Saturn-Neptune: Associated with periods of disillusionment and sobering reality checks.

Entrepreneurship is the beating heart of innovation, a relentless force that propels humanity forward into uncharted territories. From the garages of Silicon Valley to the co-working spaces of New York City, entrepreneurs have been the dreamers, the risk-takers, and the revolutionaries, shaping our world one startup at a time.

At the core of every entrepreneurial journey lies the question of capital. Some founders choose to bootstrap, relying on their own resources and revenue to fuel growth. This path offers control and autonomy but can limit the speed and scale of expansion. Others opt to raise funds from investors, trading equity for the cash needed to accelerate their growth. While this can provide the rocket fuel for rapid growth, it often comes with a loss of control and increased pressure to perform.

The world of entrepreneurship is not just shaped by the decisions of individual founders, but also by the ebb and flow of market forces, technological shifts, and cultural tides. Intriguingly, these fluctuations seem to mirror the archetypal movements of the planets above. Throughout history, significant milestones in the entrepreneurial journey have coincided with powerful planetary alignments. The birth of venture capital, the rise of Silicon Valley, the dot-com boom, and the era of unicorn startups have all coincided with the cyclical alignment of Uranus-Pluto, the archetypal combination of technological disruption.

On the other hand, the lows of the entrepreneurial world, such as the dot-com bust and the fall of once-promising billion dollar startups have coincided with Saturn-Neptune alignments, which often bring disillusionment, disappointment, and a reality check to the boundless potential of the Uranus-Pluto transits.

As we stand on the cusp of a new decade, the winds of change are blowing once again. The tides of venture capital are shifting, and a new era of entrepreneurship is dawning–the age of indie startups. In this evolving landscape, founders are increasingly turning away from the traditional paths of fundraising, opting instead to bootstrap, to build lean and efficient businesses, to prioritize profitability over growth at all costs. It's an approach that harkens back to an earlier era of entrepreneurship, one that emphasizes creativity, grit, and a deep connection to the needs and wants of customers.

The current alignment of the Uranus-Pluto trine (120º) has set the stage for a new era of entrepreneurship. This cosmological backdrop, coupled with the growing realism brought by the Saturn-Neptune conjunction (0º), is giving rise to indie startups. From the early days of venture capital to the current renaissance of bootstrapped entrepreneurs, this article will explore how the planetary alignments of Uranus-Pluto and Saturn-Neptune influence the tides of entrepreneurship.

Uranus-Pluto: The Innovative Beast

The alignment of Uranus and Pluto is associated with periods of intense innovation and technological disruption. Uranus, the planet of sudden change and radical ideas, combined with Pluto, the planet of power, destruction, and regeneration, creates an explosive force that reshapes entire industries and alters the course of human evolution.

In 2011, during the Uranus-Pluto square (90º), venture capitalist Marc Andreessen famously said, "software is eating the world," a statement that profoundly encapsulates the essence of the Uranus-Pluto archetype. Software symbolizes the Uranian aspect of digital technology, while Pluto expresses the all-consuming effect of "eating the world."

The Uranus-Pluto energy is not just about innovation for innovation's sake, but rather about the democratization of access to cutting-edge technologies and services. Just as the printing press revolutionized the spread of knowledge in the 15th century, and the automobile transformed the way we travel in the 20th century, the software and digital platforms of today are empowering billions of people around the world to connect, create, and participate in the global economy like never before.

Similarly, the democratization of entrepreneurship has had a profound impact on the global economy, unleashing a wave of innovation and creativity that has transformed virtually every industry and aspect of society. From the rise of the internet to the advent of the sharing economy, the Uranus-Pluto effect has been the driving force behind some of the most significant and transformative innovations of our time.

The Dawn of Venture Capital

The birth of modern venture capital can be traced back to the post-World War II era, a time that coincided with a soft Uranus-Pluto alignment (sextile 60º). In 1946, Georges Doriot, the "father of venture capitalism" founded the American Research and Development Corporation (ARDC), the first venture capital and private equity firm.

This pioneering era of venture capital, marked by the subtle Uranus-Pluto energy, represented a new approach to investing in and supporting innovative startups. Uranus, the planet of innovation and unconventional thinking, combined with Pluto, the planet of power and transformation, to create an environment that was ripe for disruption and growth.

The Rise of Silicon Valley

Fast forward to the 1960s–during the next major angular alignment of Uranus-Pluto–the entrepreneurial landscape was about to undergo a seismic shift. As Uranus and Pluto formed a major conjunction (0º), a group of visionary entrepreneurs were changing the world from a little-known region of California called Silicon Valley.

This period saw the birth of the "traitorous eight," a group of engineers who left Shockley Semiconductor to found Fairchild Semiconductor, a company that would become a breeding ground for Silicon Valley talent and innovation. Among these pioneers were Robert Noyce and Gordon Moore, the co-founders of Intel, and William Shockley, the father of the transistor. These men, along with a host of other brilliant minds, would lay the foundation for the technological revolution that was to come.

In the VC world, Tom Perkins, a mentee of Georges Doriot, co-founded Kleiner Perkins, an influential VC firm, and the first to open its offices on Sand Hill Road. Perkins and several other visionary investors recognized the potential of the burgeoning tech industry and poured their resources into supporting the innovative startups that would go on to shape the future.

The Dot-Com Boom

As the 20th century drew to a close, the entrepreneurial spirit was once again ignited by the next alignment of Uranus-Pluto (sextile 60º). The dot-com era had arrived, and with it came a wave of startups that promised to change the world.

VCs poured billions of dollars into early-stage startups, hoping to cash in on the next big thing. Notable investors like Mike Moritz of Sequoia Capital became household names, backing companies like Google and Yahoo!. The NASDAQ, the stock exchange where many tech companies were listed, soared to record highs as the public markets caught the dot-com fever.

The Unicorn Era

The 2010s saw the rise of the "unicorn" era, a term coined by venture capitalist Aileen Lee to describe startups valued at over $1 billion. Fueled by the next Uranus-Pluto alignment (square 90º), a new wave of technological disruption swept through industries, from transportation and hospitality to finance and healthcare.

Venture capital firms like Andreessen Horowitz, founded by Marc Andreessen and Ben Horowitz, made significant investments in companies such as Airbnb, Lyft, and Coinbase, which quickly became household names. The unicorn era also saw the emergence of new players in the VC world, like SoftBank's Vision Fund, which raised an unprecedented $100 billion to invest in startups around the globe.

Saturn-Neptune: The Trough of Disillusionment

While the Uranus-Pluto alignments have been the driving force behind the explosive growth and innovation in the entrepreneurial world, there is another cosmic duo that has played a significant role in shaping the landscape: Saturn and Neptune.

In astrological terms, Saturn represents structure, discipline, and the harsh realities of the material world, while Neptune represents dreams, illusions, and the intangible realm of the spiritual. When these two planets come together, they create a sobering effect, forcing us to confront the gap between our dreams and reality.

In the context of entrepreneurship, the Saturn-Neptune combination has often coincided with periods of reckoning and re-evaluation. It is the cosmic force that tempers the unbridled optimism and risk-taking of Uranus-Pluto, reminding us that not every startup is destined for greatness, and that even the most promising ventures can fall victim to the harsh realities of the market.

By forcing entrepreneurs and investors to confront the realities of the market, the Saturn-Neptune influence creates a more mature and sustainable ecosystem, one that is better equipped to weather the challenges and uncertainties ahead.

The Nixon Shock

The Saturn-Neptune alignment (opposition 180º) of the early 1970s coincided with the first signs of trouble, as a series of economic and political shocks occurred, including inflation, the collapse of the Brenton Woods system in 1971, and the 1973 oil crisis. This economic instability affected investor confidence and willingness to take risks, including investments in early-stage companies.

In 1973, the National Venture Capital Association (NVCA) was formed, in part to address these challenges and provide a voice for the venture capital industry. The NVCA sought to create favorable conditions for venture capital by advocating for regulatory reforms and tax incentives, such as changes to capital gains tax, which would incentivize investment in startups.

The Dot-Com Bust

The dot-com bust of the early 2000s, which coincided with a Saturn-Neptune alignment (trine 120º), brought a harsh dose of reality to the once-booming tech industry. Pets.com, a high-flying online pet supply retailer, became the poster child for the excesses and failures of the era.

Founded in 1998, Pets.com raised $82.5 million in an IPO in February 2000, despite losing money on every sale due to high shipping costs and intense competition. The company's mascot, a sock puppet dog, became a cultural icon, appearing in a Super Bowl commercial and even as a balloon in the Macy's Thanksgiving Day Parade.

However, the sobering effect of the Saturn-Neptune alignment began to expose the weaknesses in the dot-com business models, and Pets.com's fortunes quickly unraveled. By November 2000, just nine months after its IPO, the company announced it was shutting down, laying off 255 employees and liquidating its assets. The rise and fall of Pets.com served as a cautionary tale for the dangers of irrational exuberance and the importance of sound business fundamentals, even in the face of technological innovation.

Deflating Unicorns

The WeWork saga of 2019 exemplifies the beginning of the downfall of the unicorn era during a Saturn-Neptune alignment (sextile 60º). Founded in 2010 by Adam Neumann, WeWork aimed to revolutionize the traditional office space model with its sleek, community-focused co-working spaces. Fueled by massive investments from venture capitalists like Masayoshi Son, who poured over $10 billion into the company, WeWork's valuation soared to a staggering $47 billion by 2019.

However, as WeWork prepared for its highly anticipated IPO, cracks began to appear in its glossy facade. Investors and analysts raised concerns about the company's ballooning losses, Neumann's erratic behavior and leadership, and the sustainability of its business model. As the Saturn-Neptune transit unfolded, WeWork's IPO plans unraveled spectacularly. The company's valuation plummeted by over 80%, Neumann was forced to step down as CEO, and thousands of employees were laid off.

WeWork's downfall served as a stark reminder of the dangers of unchecked growth, founder ego, and the disconnect between lofty valuations and actual profitability. The unicorn era, once fueled by the explosive growth of Uranus-Pluto's energy, had run headlong into the sobering reality check of the Saturn-Neptune transit.

Current Climate: The Rise of Bootstrapping

Now, as we find ourselves in the midst of another potent Uranus-Pluto alignment (trine 120º–until 2032) as well as a Saturn-Neptune alignment (conjunction 0º–until 2027), the entrepreneurial landscape is once again shifting. But this time, something is different. Instead of chasing the next big funding round or the coveted unicorn status, entrepreneurs are increasingly turning to bootstrapping—the art of building a startup without external funding.

In a blog post from late 2023, venture capitalist Bryce Roberts writes: "Today, the fuel for startups and the oxygen for funds are being cut significantly. There is less available capital and appetite for burn. As the now weekly headlines highlight, those who aren’t adapting to this new reality are finding themselves in piles of smoldering embers." The numbers paint a striking picture, as highlighted in a recent analysis by Carta and amplified by X influencer Greg Isenberg's comment indicating that the majority of startups shutting down are predominantly VC-backed.

Okay, gotta get something off my chest.

Everyone's freaking out about this chart from Carta that signals the startup apocalypse.

254 startups shut down in Q1 2024. Up 58% from last year. Sounds terrifying, right?

But, no-one is talking about one key point from this data.… pic.twitter.com/1VayiUoCx3— GREG ISENBERG (@gregisenberg) August 20, 2024

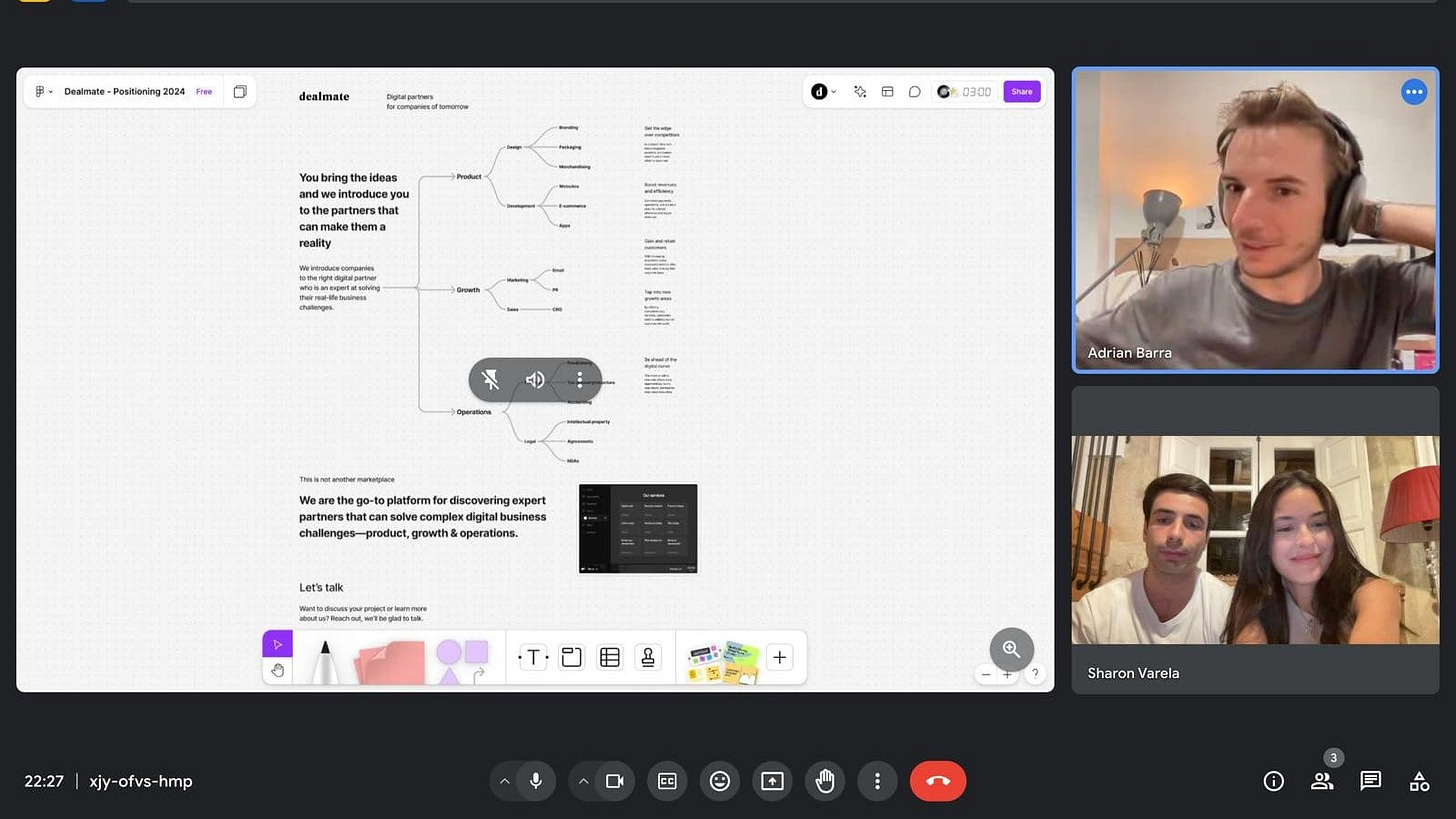

I recently interviewed Adrian Barra, co-founder of dealmate, an all-in-one matchmaking platform that connects companies with service providers. Adrian recently shifted from fundraising to bootstrapping his company and reflected on this transition: “We knew 2023 wasn’t an ideal year for fundraising, but since the new year (2024) was around the corner, we hoped for the best, and began our fundraising campaign in January. We sat down as a team and asked: "How close are we to breaking even? When will we generate enough cash flow to cover the monthly burn rate?" It looked like it could take more than 12 months, maybe 9, maybe 15, but nothing was for sure. What we did know was that we weren't going to make it past summer. So we decided, "let’s start fundraising now." Even though we knew it might take months, we wanted to get ahead of it and reassess come September."

Adrian recounts the challenges of their campaign, saying, “This journey has been tougher than expected, because the timing wasn't there. And I truly believe that we have a great project. When we entered this territory of having only a few months left, we really had to switch our mentality. And that's when I realized that when you are in this race from one ground to the other, you're not truly thinking that you have a company or a business that has to make money. You are used to being in a weird space where you just get money and spend it and hope to get more money and hope to spend it, so you can get more money. And there's a point where you don't even care about being profitable. Because, you know that at some point, someone is going to acquire you or at least that there'll be a big payoff. It doesn't matter if it's profitable or not; you make a big exit and that's it. And I was like, "wait a second...is this really a business or just a fantasy that is not sustainable?""

"I think that's why bootstrapped startups are rising," Adrian says, as he shares his opinion on the current climate, "because people are lowering their expectations. It's not anymore about an IPO or an acquisition. That's nice but now people want a SaaS platform, or a company that has 10, 20, 30k MRR (monthly recurring revenue); a good 80/70% profit of that and they are set. They are above average at that point."

Adrian and his co-founders are in the trenches, and this is the wisdom he provides to fellow boostrappers: "Start thinking from first principles. Instead of taking a general piece of advice and going in that direction, think about your own case. So okay, you are building a SaaS platform, do you need an app for a platform? Maybe yes, but maybe that's for scalability. So maybe at the beginning it could be a platform, or something like a form that collects information and does something with that. Imagine, maybe Uber could have started with a simple request: you call Uber, as if it was a telephone and you say, "I want a trip from point A to point B" and then they call a driver and say "you have to be there, and you have to go there." That could've happened and then they could've built more technology like an app for the iPhone, and scaled. But the business is still the same. For people who are more tech-oriented, think about how you can do it as simply as possible. It's not as sexy, it's not as scalable, it's not everything but it's truly a way to validate it, and you can go from there. That's our grandparent's mentality–they didn't start with three or five stores, they started with a small corner."

VC-backed startup vs Bootstrapped founder pic.twitter.com/xKR84DX3VV

— Adrian Barra (@adrianpbarra) August 20, 2024

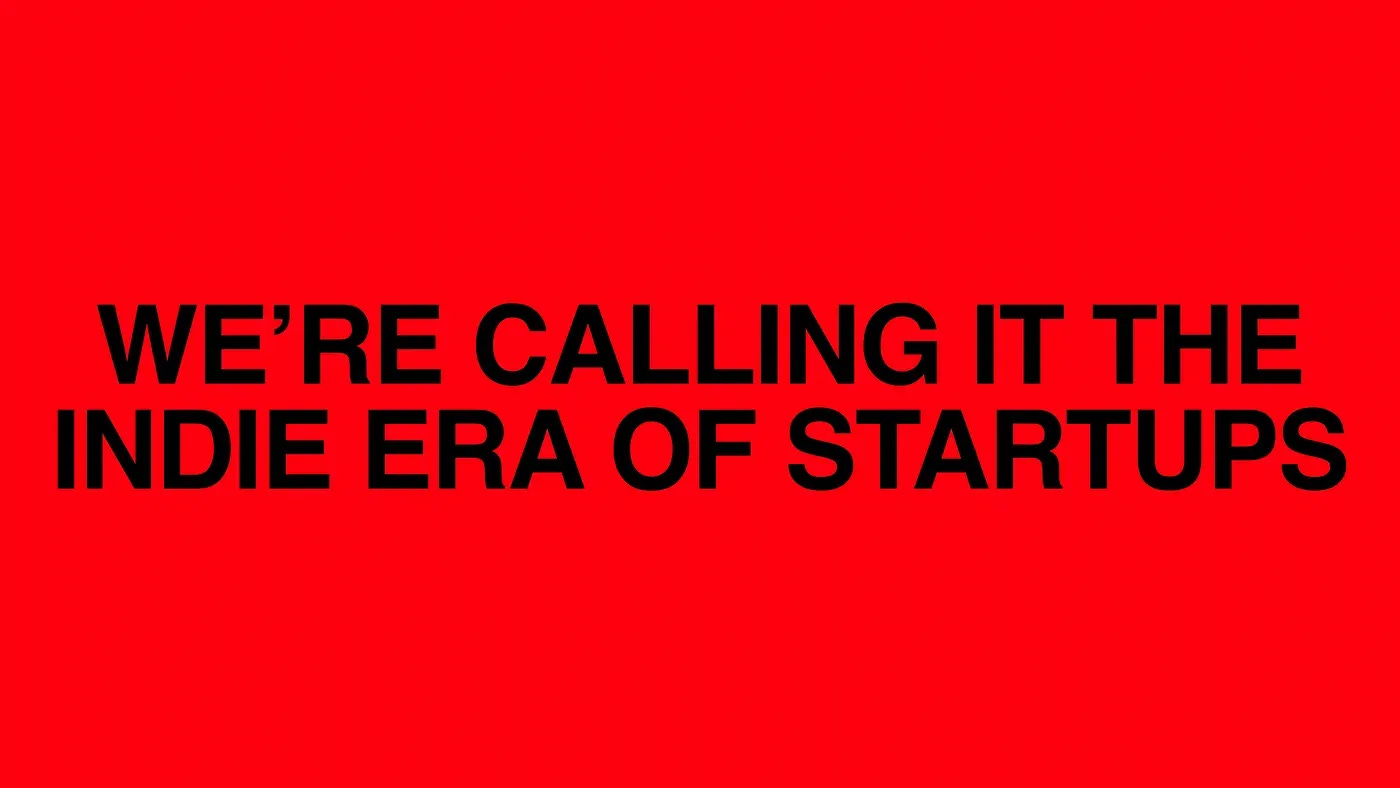

The Indie Era of Startups is Here

A new breed of entrepreneurs is emerging, one that is embracing radical independence with skillful minimalism. As the Olympics shooter meme that Adrian shared expresses: the era of flashy VC-backed glamor is out, and the bootstrapped era of profound self-reliance is in.

Entrepreneurs are no longer content to chase the fleeting promises of VC funding and hyper-growth. Instead, they are seeking a more authentic, sustainable path—one that allows them to build something that truly matters, something that can stand the test of time. As Bryce Roberts eloquently states: "If the unicorn era taught us one thing, it’s that more isn’t always the answer. More money doesn’t solve fundamental problems. More people don’t move faster. More features don’t fix product market fit." In his blog post, Bryce lays out a manifesto for the Indie Era of Startups:

So as we stand on the cusp of a new era in entrepreneurship, it is clear that the cosmic forces of Uranus-Pluto and Saturn-Neptune will continue to shape the landscape. The age of indie startups is upon us, and with it comes a renewed sense of purpose, authenticity, and growth.

The entrepreneurs of today are not just building startups; they are building movements. They are tapping into the deep well of human potential, drawing on the lessons of the past to create a brighter, more sustainable future. And they are doing it all with the power of bootstrapping.

As we stand on the precipice of this age, we are called to embrace the mysterious interplay of innovation (Uranus) and transformation (Pluto), as well as practicality (Saturn) and imagination (Neptune). It is time to break free from the chains of the past and chart a new course forward. The future of entrepreneurship lies in the hands of bold adventurers, and it all begins with a single, bootstrapped step.