Crypto Market Uncertain Despite Mars Crossing of Jupiter-Uranus Soon

As the Jupiter-Uranus transit (2023–2024) unfolds, crypto summer begins.

Crypto markets continue to show mixed signals and sideways choppiness despite the upcoming Mars crossing of the Jupiter-Uranus hard alignment. We anticipate a major infusion of positive momentum entering the crypto bull market, led by Bitcoin, beginning on the 4th of July and deepening through August and the end of the year.

Jupiter-Uranus hard alignments have always coincided with Bitcoin all-time highs to date: 2013, 2017, and 2021. Briefly described, Jupiter-Uranus periods coincide with a sudden burst of technological optimism, as well as a global spark of buoyancy.

Bitcoin’s Jupiter-Uranus History

The Jupiter-Uranus conjunction has been in orb since last summer and has gradually strengthened, with the peak conjunction occurring the weekend of April 22nd. We've been astounded and thrilled to observe the thesis play out this time as well, with Bitcoin hitting a new peak in March 2024.

The current Jupiter-Uranus alignment has been in play since May 2023 and will remain in orb until March 2025. More interesting has been an additional layer that's factored into our research regarding the role Mars has historically played in "triggering" the energetic qualities of Jupiter-Uranus. This point was first raised by PhD candidate Maximilian DeArmon at CIIS in San Francisco, CA. For us at Numinous Realm, a research team focused primarily on the outer planets for nearly a decade (Saturn, Uranus, Neptune, Pluto), even shifting into Jupiter research has been a new step led by co-founder Somya Thakker Desai. Incorporating Mars into our analysis has brought a new layer of timing that was previously not a factor.

The overall crypto market, including its key analysts and influencers, is stuck observing only "material" trends as the basis of their decision-making. Material factors—such as Bitcoin halving and ETFs—are a critical part of fundamental analysis, but there is an additional layer of triangulation being developed in financial markets that could be considered a form of archetypal analysis. This should ideally be taken into consideration alongside the major forms of financial analysis: fundamental analysis of metrics and technical analysis of charts.

Of course, archetypal prediction is a dark art at Numinous Realm, something we hold lightly while acknowledging the realities of multivalence and multidimensionality. Woe be to those who confuse the idea of correlation with concreteness. And yet, it has been somewhat amusing to observe even large names in the crypto sphere gradually capitulate from Bitcoin bearishness to bullishness as the Jupiter-Uranus transit has unfolded. Here is a brief timeline of sentiment:

Jan 26, 2024

Bitcoin Could Fall Back to Mid-$20K Area: Chris Burniske

February 1, 2024

It May Be Time for Bitcoin Traders to Focus on John Bollinger’s Price Bands Again

February 28, 2024

Bitcoin Tops $63K for First Time Since November 2021

April 29, 2024

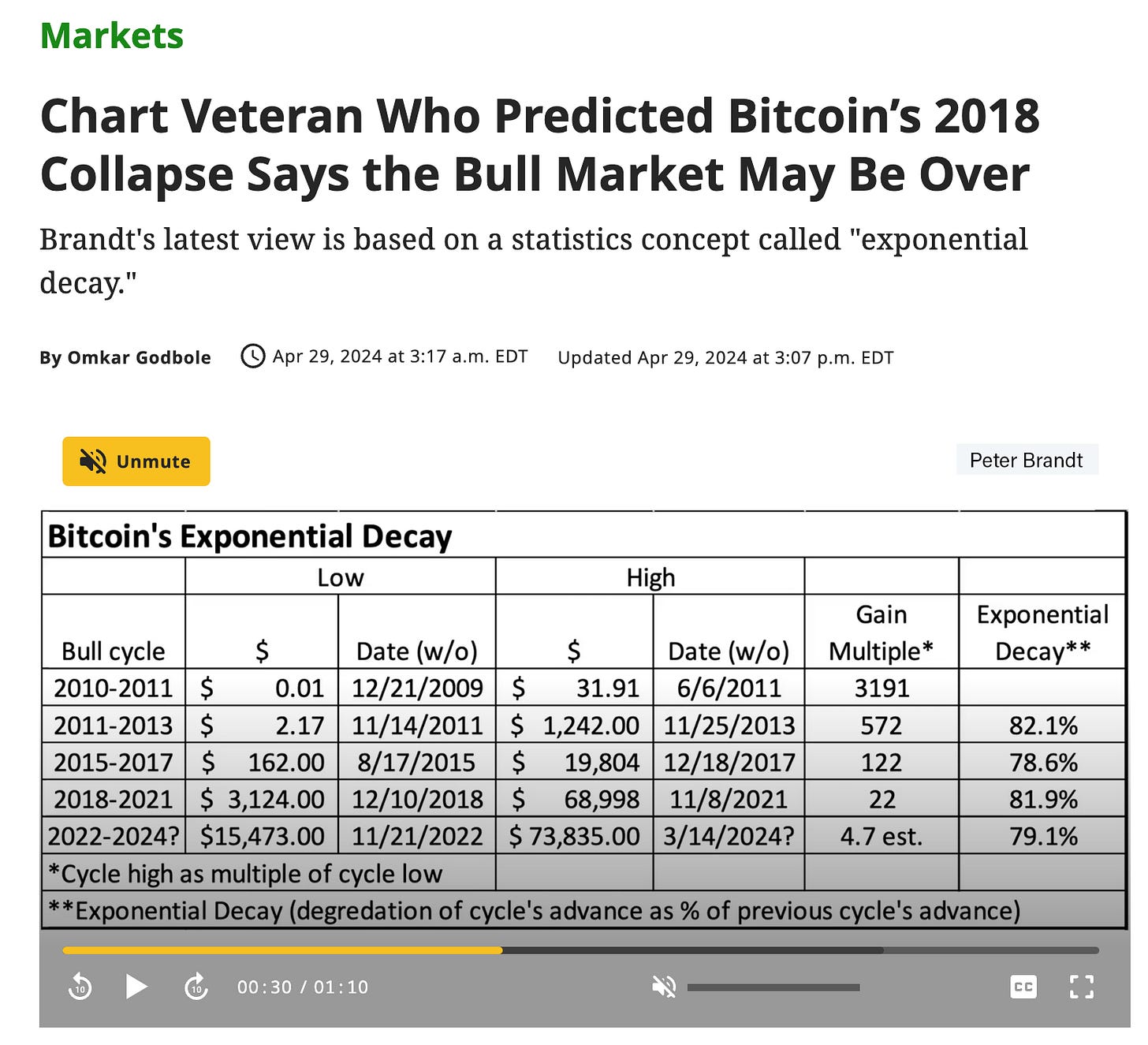

Chart Veteran Who Predicted Bitcoin’s 2018 Collapse Says the Bull Market May Be Over