Gen Z Rewrites Love and Money

Women's independence heightens during Uranus-Pluto world transits. Discover how Gen-Z women are making bold moves as the Uranus-Pluto trine unfolds.

We are living in a time where financial independence and equality are more important than ever. Gen Z is breaking the mold of traditional relationship dynamics.

A recent Bankrate report highlights a striking trend: nearly 1 in 4 married millennials and Gen Z couples keep their finances separate, with 65% of cohabiting but unmarried couples doing the same. Gen Zers are the most likely to keep their money completely separate from their spouse or partner, at 38 percent.

Why the change? It's about more than just dollars and cents. It’s a revolution rooted in personal freedom, equality, and modern values.

Resonance with Uranus-Pluto Trine (120° orb)

The Uranus-Pluto trine, occurring from August 2021 to May 2032, embodies the archetypal energies of innovation and transformation. Uranus, the planet of sudden change, rebellion, and innovation, represents the drive toward individual freedom and breaking away from old structures. Pluto, the planet of deep transformation, power dynamics, and regeneration, symbolizes the profound shifts and rebirth that follow the upheaval of old systems. When these two planets form a harmonious trine, their combined energies facilitate a smoother integration of revolutionary changes that deeply transform societal structures.

This alignment is fostering a societal shift towards financial autonomy, transparency, and personal freedom in relationships. The Uranus-Pluto trine supports breaking free from traditional financial arrangements, encouraging innovation in how finances are managed and promoting more equitable and independent financial practices. This energy is about dismantling outdated systems and rebuilding them in ways that empower individuals and align with modern values of equality and personal freedom.

A Look Back: Financial Evolution

1928-1937 Uranus-Pluto Square (90° orb): Economic Crisis and Social Shifts

The Uranus-Pluto square from 1928 to 1937 coincided with the Great Depression, a time of immense economic upheaval. The 1929 Wall Street Crash triggered widespread unemployment and poverty, leading to significant financial reforms like the Glass-Steagall Act of 1933 to restore stability.

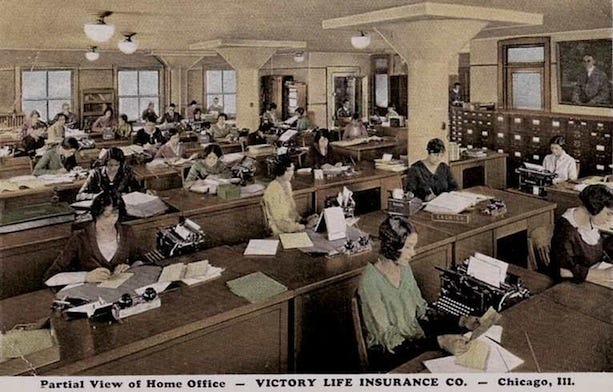

Economic hardship forced many women to become primary earners. By 1930, nearly 50% of single women and 12% of married women were employed, reflecting the necessity for additional income during this challenging period. This marked a shift in traditional gender roles, although the types of jobs available to women were often limited to lower-paying and less secure positions.

1940s-1950s: The Post-WWII Boom

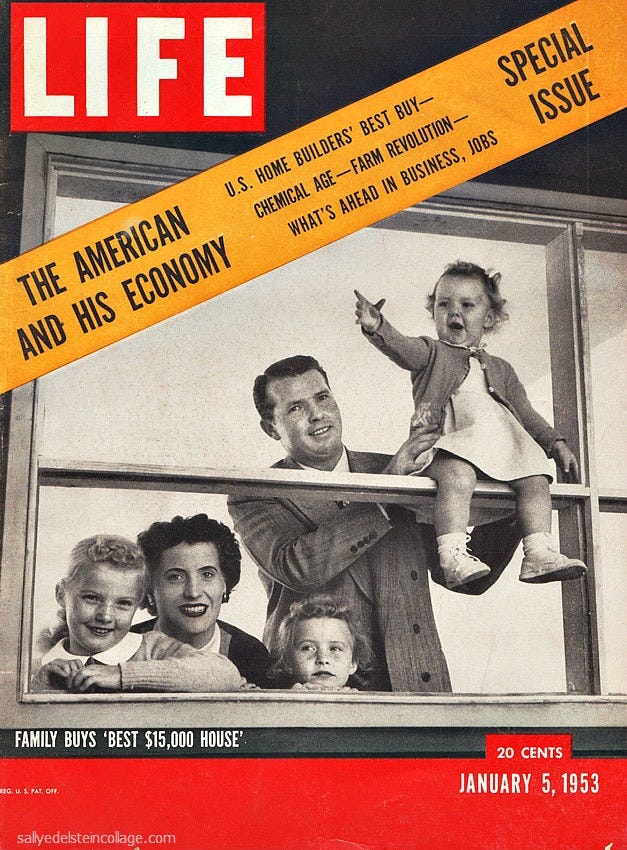

During the immediate post-war years, from 1945 to the early 1950s, millions of women who had stepped into the workforce during World War II found themselves replaced by returning soldiers. Popular culture and mass media urged these women to surrender their jobs and return to domestic life, reinforcing traditional family structures.

The Saturn-Pluto conjunction (1946-1948) was particularly influential in shaping societal norms during this period. Saturn's energy emphasized duty, structure, and responsibility, while Pluto's transformative power reinforced societal norms and stability. The combined influence of these planets brought a return to traditional gender roles, with men as breadwinners and women as homemakers.

The economic boom of the early 1950s was further supported by the Saturn-Pluto sextile (1952-1953), a softer, more harmonious aspect. This alignment promoted financial stability and growth. Finances were typically managed by the male head of the household, with joint accounts being common, reflecting the collective responsibility of managing household finances.

1965-1966 Uranus-Pluto conjunction (0° orb): Social Movements and Economic Change

But then the next Uranus-Pluto conjunction (1965-1966) ignited significant social movements, notably the women’s liberation movement, pushing for gender equality and financial autonomy. More women entered the workforce, leading to the rise of dual-income households.

The women's liberation movement advocated for financial independence, resulting in the emergence of separate bank accounts. This period was a critical turning point in redefining gender roles and financial practices within relationships, reflecting the growing desire for equality and personal freedom.

2007-2020 Uranus-Pluto square (90° orb): Financial Crises and Millennial Influence

The Uranus-Pluto square (2007-2020) highlighted the importance of financial literacy and independence following the 2007-2008 financial crisis. Millennials, dealing with economic uncertainty and high levels of student debt, often prioritized financial independence and transparency in relationships, leading to a resurgence in the popularity of separate accounts.

In the 2020s, the Uranus-Pluto trine (2021-2032) aligns with the rise of fintech and digital banking, making financial management more accessible. Gen Z values financial autonomy within relationships, reflecting broader societal trends toward equality and personal freedom.

Synchronic Events Shaping Financial Independence Today

Today, financial independence is being shaped by technological advancements, cultural shifts, and economic factors. These elements contribute to the increasing trend of financial autonomy within relationships.

Technological Advancements Digital banking and fintech solutions have revolutionized how individuals manage their finances. Mobile payment apps, budgeting tools, and online investment platforms provide easy access to personal financial management, enabling Gen Z to handle their money independently and efficiently.

Cultural Shifts: Changing attitudes toward marriage and cohabitation are influencing financial management within relationships. Many young adults, including those from Gen Z, are delaying marriage or choosing to live together without tying the knot. This reflects a desire for financial autonomy and flexibility, aligning with broader societal trends toward equality and personal freedom.

Economic Factors High levels of student debt and the rise of the gig economy have necessitated a more cautious and independent approach to financial management. Keeping finances separate allows individuals to manage personal debts and financial goals without burdening their partner, reflecting a pragmatic response to economic realities.

Emerging Psychological Trends

Imagine a world where financial independence in relationships isn't just a necessity but a celebration of autonomy and equality. Gen Z embodies this vision, prioritizing control over their finances to avoid dependency and ensure personal freedom. This shift isn't just monetary; it’s about redefining relationship dynamics to foster mutual respect and equality.

However, this approach comes with challenges. Financial secrecy can lead to trust issues, complicating budgeting and long-term planning. Disparities in income and financial contributions can create tensions and feelings of inequity, causing emotional strain and impacting relationship satisfaction.

On the other hand, maintaining financial independence allows each partner to retain control over their finances, fostering independence and self-sufficiency. Clear boundaries around money can reduce conflicts related to spending habits and financial priorities. Regular financial discussions can improve communication and strengthen the relationship.

Picture a relationship where both partners feel empowered and respected, with financial autonomy enhancing their bond. This ideal includes open communication about finances, a balanced approach to financial responsibilities, and mutual support in achieving both personal and joint financial goals.

Future Outlook

The current trend towards financial independence and autonomy within relationships, driven by Gen Z, reflects broader societal values of equality, transparency, and personal freedom. As technological advancements continue to revolutionize personal finance management and societal attitudes toward relationships evolve, we can expect these trends to deepen.

Future generations may prioritize even greater financial independence and equality, reflecting an ongoing transformation in how we manage our personal and collective resources. The unfolding societal landscape will likely see continued innovation in financial tools and practices, fostering a culture of financial literacy and empowerment.